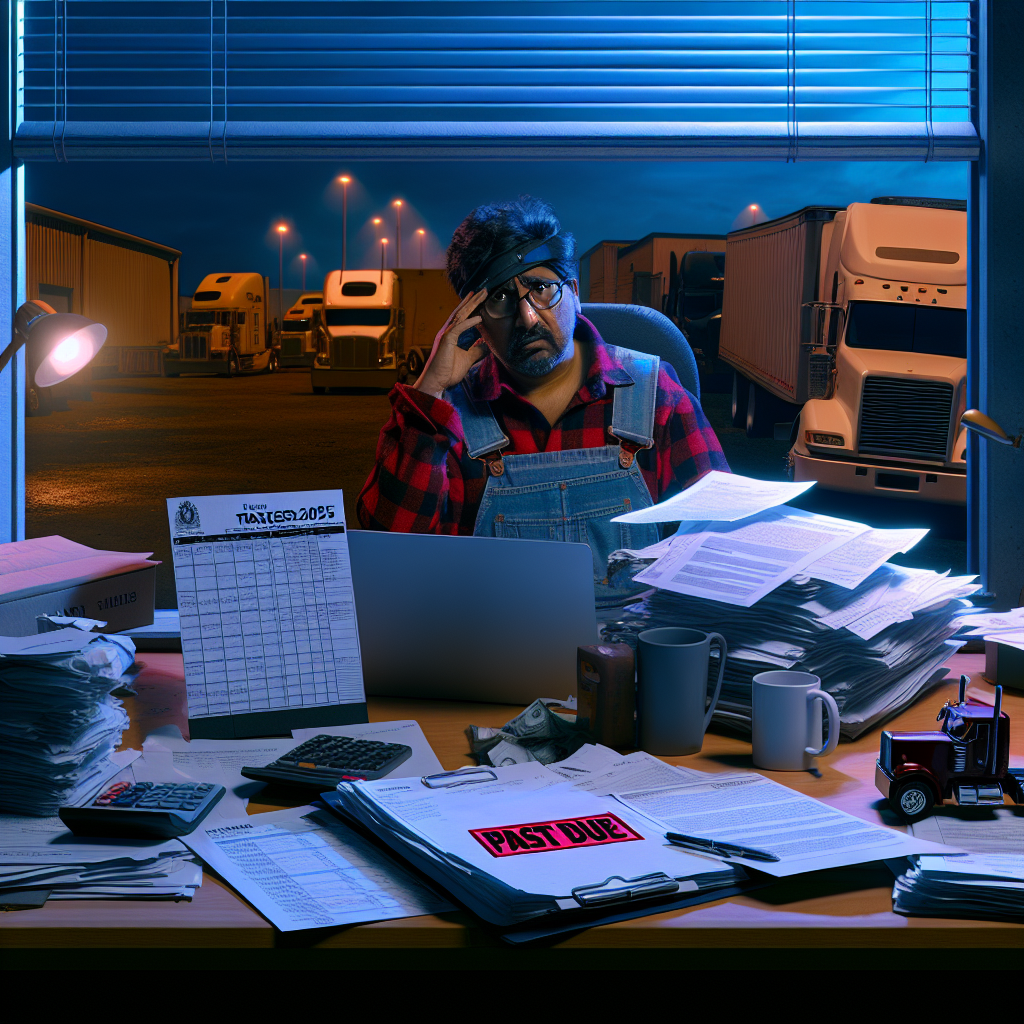

Why this matters now

Unfiled or late tax returns are more than back-office headaches for motor carriers. They can stall registrations, delay contracts, and drain cash flow through fast-accumulating penalties and interest. A recent industry guide highlights the IRS’s Trucking Tax Center as a reliable hub for fleet-specific rules and filing steps—timely, given the 2025 compliance calendar now in full swing.

What counts as “unfiled” for trucking businesses

- Income/business returns: Sole proprietors (Schedule C), partnerships (Form 1065), S corporations (Form 1120‑S), and C corporations (Form 1120) must file on time even if cash is tight.

- Heavy Highway Vehicle Use Tax (HVUT): File Form 2290 for each taxable vehicle (55,000+ lbs.). For trucks first used in July, the deadline is August 31; otherwise it’s the last day of the month after first use. E‑file is required if reporting 25 or more vehicles. Page last reviewed September 17, 2025.

- Employment/payroll taxes: Return filings (e.g., Forms 941/940) and timely deposits are mandatory for fleets with W‑2 drivers.

The cost of waiting: penalties, interest, and payroll deposit additions

- Failure-to-file (most income/business returns): 5% of unpaid tax per month or part-month, up to 25%. For returns due after December 31, 2024 (e.g., 2024 Form 1120/1040 filed in 2025), the minimum late-filing penalty is $510 if over 60 days late.

- Failure-to-pay: 0.5% per month, up to 25%; drops to 0.25% while an installment agreement is in effect and can rise to 1% after a final levy notice. Interest compounds daily at the federal short‑term rate plus 3%.

- Payroll “failure‑to‑deposit” penalties (missed or incorrect timing/amount/method): 2% if 1–5 days late, 5% at 6–15 days, 10% beyond 15 days, and 15% if unpaid more than 10 days after your first IRS notice or on immediate‑payment notice.

Bottom line: Filing stops the 5% late‑file meter; paying (or setting up an agreement) shrinks the late‑pay and interest clock. Waiting amplifies both.

How collections escalate for fleets

- Substitute for Return (SFR): If you don’t file, the IRS may create a return from third‑party data—often overstating liability and omitting deductions—then assess and collect.

- Liens and levies: Nonpayment can trigger federal tax liens and levies on accounts receivable and equipment; interest and penalties continue until paid.

- Trust Fund Recovery Penalty (TFRP): “Responsible persons” who willfully fail to remit withheld payroll taxes can be held personally liable for the full trust‑fund amount. Owners, officers, and controllers are at risk.

Fast track to get current—and keep trucks moving

- Map your gaps: List all missing returns (income, payroll, 2290). Pull IRS transcripts to see what the agency has on file before filing back returns.

- File even if you can’t pay: Filing halts the 5% failure‑to‑file penalty and positions you for payment options. Prioritize Form 2290 filings needed for registrations; e‑file for quickest Schedule 1 turnaround.

- Stabilize payroll compliance: Enroll in EFTPS, set calendar reminders tied to your deposit schedule, and reconcile each pay cycle. This avoids the 2%–15% failure‑to‑deposit tiers.

- Choose a payment plan early: Online payment agreements reduce the monthly failure‑to‑pay rate to 0.25% while in effect; pay what you can up front to cut interest.

- Seek penalty relief where warranted: First‑Time Abatement or reasonable‑cause requests can remove some penalties; interest only falls if the related penalty is removed. Document disruptions (e.g., disasters, records loss) and respond by stated deadlines.

- Tighten recordkeeping: Keep VINs, gross weight, and first‑use dates for each unit (2290); maintain payroll and driver status documentation (W‑2 vs. 1099); and retain fuel/mileage records that support filings.

The takeaway for owners and fleet managers

In 2025, the math is unforgiving: a few missed deadlines can cascade into double‑digit add‑ons and personal liability if payroll taxes are involved. Use the IRS Trucking Tax Center as your reference point, get delinquent returns filed, and lock in payment agreements before collection intensifies. It’s the fastest way to protect operating authority, credit, and cash flow.

Sources Consulted: Get Tax Relief Now; Internal Revenue Service (Trucking Tax Center; Failure‑to‑File Penalty; Failure‑to‑Deposit Penalty; Collection Procedural FAQs on penalties and interest; Form 2290 Instructions; Trust Fund Recovery Penalty).

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.