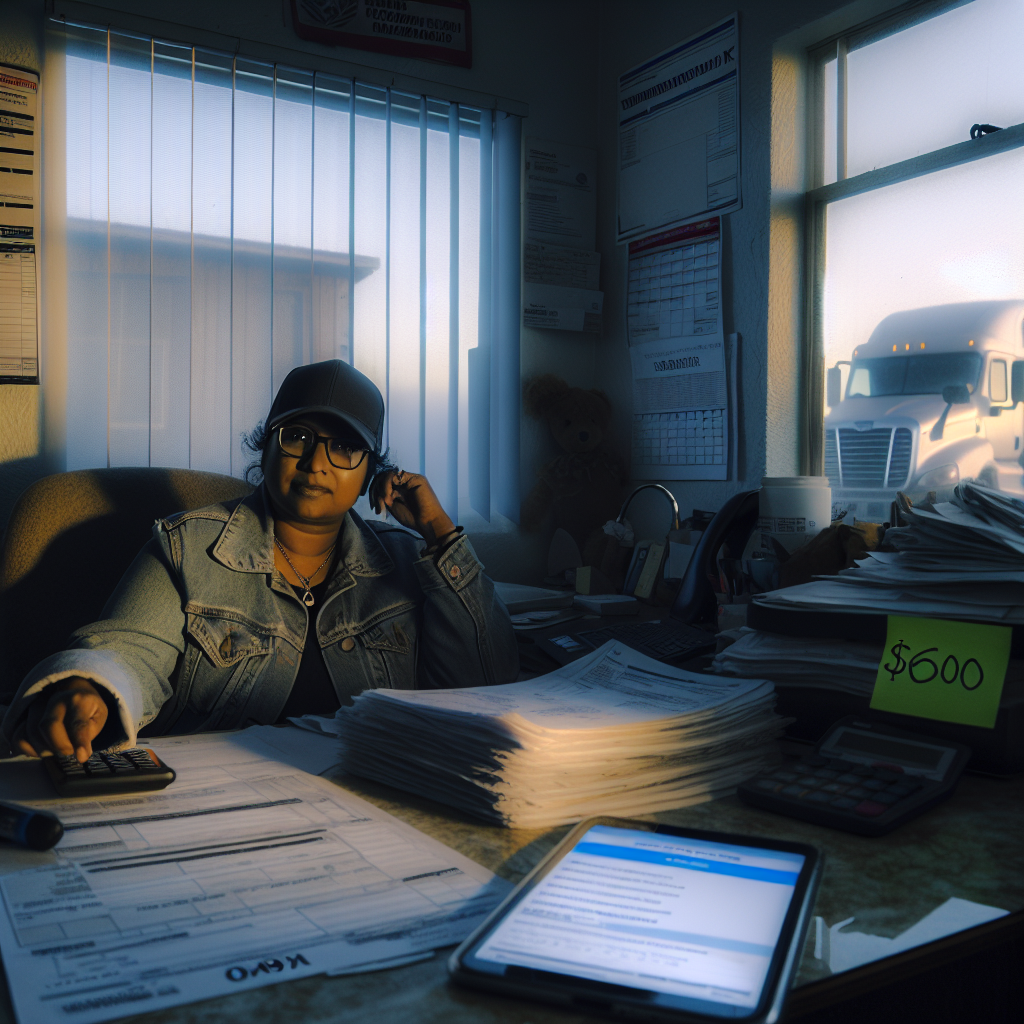

Why owner-operators and fleets are hearing about a “$600 rule”

If you’ve ever been paid through Venmo for a side haul, roadside repair, or parts resale, you’ve likely heard about a “$600 rule.” That nickname refers to a federal change Congress passed in 2021 that would have required payment apps to send Form 1099-K when users received $600 or more for goods and services in a year. But after multiple delays, federal policy shifted again in late 2025. As of January 7, 2026, the federal 1099‑K threshold has reverted to more than $20,000 and more than 200 transactions for a calendar year. Personal (friends-and-family) transfers remain excluded.

What’s the rule now? A quick timeline for 2024–2026

- Tax year 2024 (forms issued by January 2025): Transitional federal threshold of $5,000 for total payments for goods/services via third‑party settlement organizations (TPSOs) such as Venmo.

- Tax year 2025 (forms issued by January 2026): Congress’s 2025 law restored the pre‑ARPA standard—more than $20,000 and more than 200 transactions—at the federal level.

- Tax year 2026 and beyond: The restored federal threshold (>$20,000 and >200 transactions) remains in effect unless Congress changes the law again. Always check current IRS guidance each season.

Regardless of thresholds, taxable income is still taxable. You must report business income even if you don’t receive a 1099‑K.

State exceptions that can still trigger a 1099‑K

Several states require platforms to issue a 1099‑K at lower levels. For example, Maryland, Massachusetts, Vermont, and Virginia use ≥$600, and Illinois uses >$1,000 with 4+ transactions. If you operate or reside in one of these states, Venmo may furnish a form even when you’re below the federal threshold.

What counts as “goods and services” on Venmo

- Business receipts: Payments for hauling, towing, roadside service, parts sales, or other business activities are reportable business income.

- Personal transfers: Paying a co-driver back for meals, reimbursing a dispatcher for a shared hotel room, or sending money to family/friends should not be reported on a 1099‑K if properly labeled as personal.

Practical steps for truckers using Venmo

- Separate business from personal: Use a distinct business profile/account for freight or repair income so “friends & family” reimbursements don’t get mislabeled as sales. Clear labeling helps avoid incorrect forms.

- Provide your TIN/EIN: If a platform can’t match your account to a valid taxpayer ID, it may apply 24% backup withholding to reportable payments, creating cash‑flow pain you’ll have to reconcile at filing.

- Track everything: Keep invoices, settlement statements, and mileage/expense logs. Reconcile any 1099‑K totals with your books (and bank statements) by month.

- Watch state rules: If you’re domiciled in a $600‑threshold state—or run a lot of work there—expect state-driven 1099‑K reporting even when federal rules wouldn’t trigger a form.

- Fix mistakes fast: If you receive a 1099‑K that includes personal transfers or the wrong amount, contact the platform promptly to correct it before filing. The IRS provides guidance for handling incorrect or unexpected forms.

Truck-specific examples

- Reimbursing a driver via Venmo for a lumper fee: Personal reimbursement—not income; should be labeled accordingly and tracked in your books.

- Being paid via Venmo for an emergency tow you performed: Business income; report it whether or not you receive a 1099‑K.

- Selling a used seat for less than you paid: Generally not taxable because it’s a personal item sold at a loss; keep records in case a form is issued in error.

- Selling spare parts for more than your basis: The gain is taxable; document your cost and sale price.

Bottom line for fleets and O/Os

The “$600 rule” is a catchy label, but it’s not the federal standard today. For 2025 returns (filed in 2026) and going forward, federal 1099‑K reporting for payment apps has returned to the >$20,000 and >200‑transaction threshold—though some states use lower thresholds. Keep business and personal payments separate, share your tax ID with platforms, and report all income from goods and services—1099‑K or not.

Sources Consulted: Internal Revenue Service (IRS) newsroom and forms guidance; Venmo Help Center; IRS Taxpayer Advocate Service; Ernst & Young Tax News analysis.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.