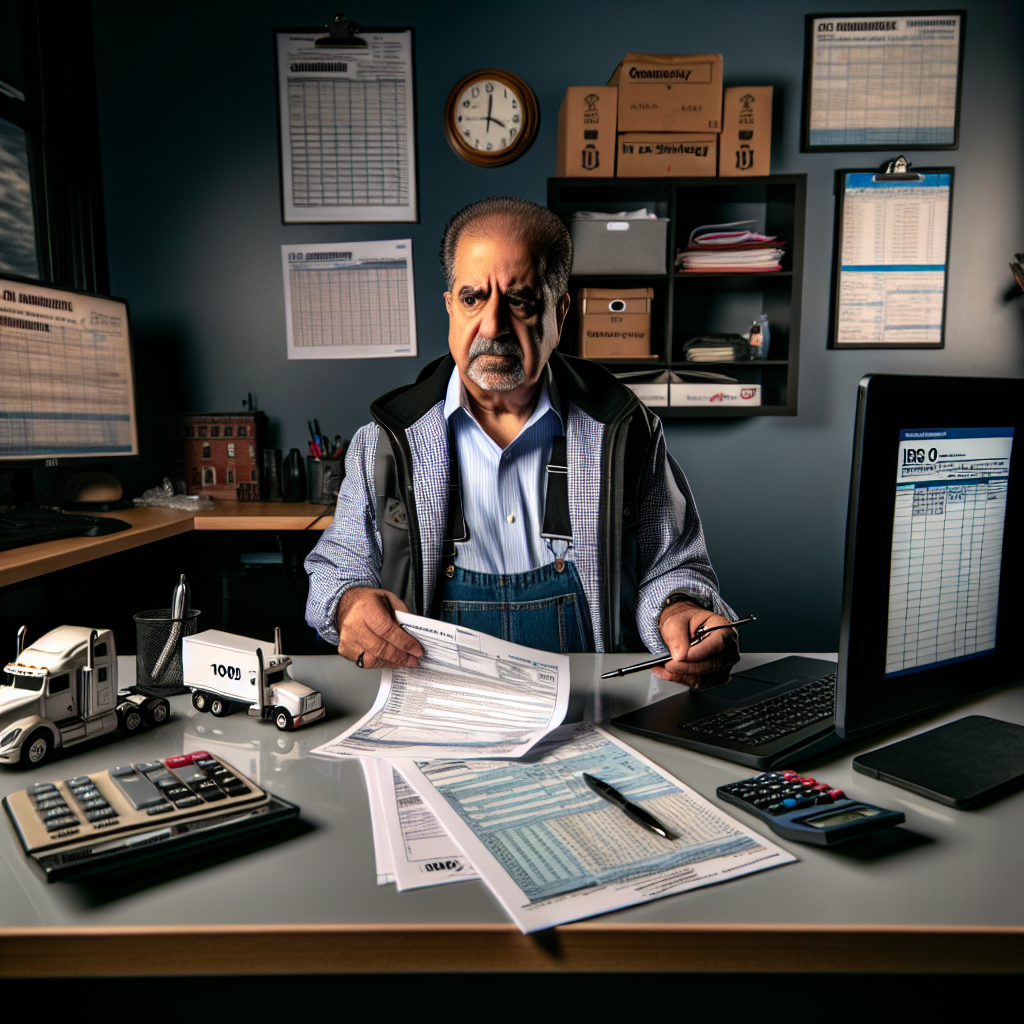

Why this DC tax lawyer matters to trucking

For owner-operators and fleet finance teams trying to plan capital spending and navigate audits in 2026, few attorneys have a résumé more tuned to the moment than Jeffrey H. Paravano, a Washington, D.C.–based partner at BakerHostetler. With more than 30 years in tax controversy and litigation—including work in the U.S. Treasury’s Office of Tax Policy—Paravano is recognized by Chambers USA for his experience “dealing with the IRS and Congress.” His current focus areas include Inflation Reduction Act (IRA) credits and 2025 tax legislation—exactly where fleets are feeling the ground shift.

Key 2025–26 tax changes affecting trucks, trailers and technology

- Commercial Clean Vehicle Credit window closed for most new acquisitions. The Section 45W credit (up to $7,500 for vehicles under 14,000 lbs. GVWR and up to $40,000 for heavier units) now applies only to vehicles acquired on or before September 30, 2025, with a binding contract/payment by that date; vehicles placed in service after that must still meet the acquisition deadline. That means 2026 purchases without 2025 acquisition documentation generally won’t qualify. Fleets should retain contracts, deposits and delivery records to substantiate eligibility.

- 100% bonus depreciation is back for qualified property acquired after Jan. 19, 2025. The 2025 law change restored full expensing under IRC §168(k) for eligible assets—think tractors, trailers, shop equipment, and many onboard technologies—acquired after Jan. 19, 2025 (with special rules for property placed in service during the first taxable year ending after that date). This materially improves cash flow modeling for 2026 purchases.

- Higher Section 179 expensing limits help small and mid-size fleets. For tax year 2025, the IRS set the Section 179 expensing cap at $2.5 million with a $4.0 million phase-out threshold. For planning purposes, industry guidance shows those amounts indexed higher for 2026 (about $2.56 million cap and $4.09 million threshold), but confirm your final numbers when the IRS publishes your filing-year instructions.

- ERC cleanup remains an active IRS priority. If your company filed Employee Retention Credit claims during or after the pandemic, be aware the IRS continues to screen for ineligible claims. A withdrawal process—avoiding penalties and interest—remains available for unpaid or uncashed claims. Expect continued audits and correspondence through 2026.

What fleet managers should do now

- Lock down documentation for any 45W claims. Assemble proof of acquisition by Sept. 30, 2025 (binding contract, deposit) and placed-in-service dates. Confirm GVWR, battery capacity, and “incremental cost” analysis, which can cap your credit.

- Re-run 2026 capex models using 100% bonus depreciation. The return of full expensing can change your payback math on tractors, trailers, APUs, shop lifts and diagnostic equipment. Coordinate Section 179 and bonus depreciation to avoid wasting deductions in low-income years.

- Mind “listed property” rules on vehicles and telematics. Maintain contemporaneous mileage/use logs to preserve deductions; dropping under 50% business use can trigger depreciation recapture.

- Scrub any ERC exposure. If marketing firms pushed you into a questionable filing, talk to a qualified tax advisor about the IRS withdrawal pathway before audits and interest stack up.

Where Paravano’s expertise fits

Fleets confront a thicket of interactions: proving 45W eligibility under compressed timelines, optimizing 100% expensing alongside Section 179, and responding to IRS notices on ERC or fuel-tax issues. Paravano’s mix of policy background and controversy practice is built for that intersection—advising on structuring transactions, shepherding credits, and defending positions when the IRS challenges them. His team’s focus on IRA credits and 2025 legislation signals ongoing counsel on the very provisions reshaping trucking balance sheets in 2026.

Bottom line for trucking

The tax landscape that fleets planned around in early 2025 is not the one they face today. With the 45W acquisition window closed, expensing power restored, and ERC enforcement accelerating, 2026 strategy is about documentation and timing as much as it is about specs and sticker price. That’s why specialists like BakerHostetler’s Jeffrey H. Paravano—who spend their days at the IRS–Congress–industry nexus—are increasingly on speed dial for trucking CFOs and owner-operators alike.

Sources Consulted: BakerHostetler; Internal Revenue Service; U.S. Department of the Treasury; Iowa State University Center for Agricultural Law and Taxation; U.S. Bank Equipment Finance.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.