What’s happening and why it matters to trucking

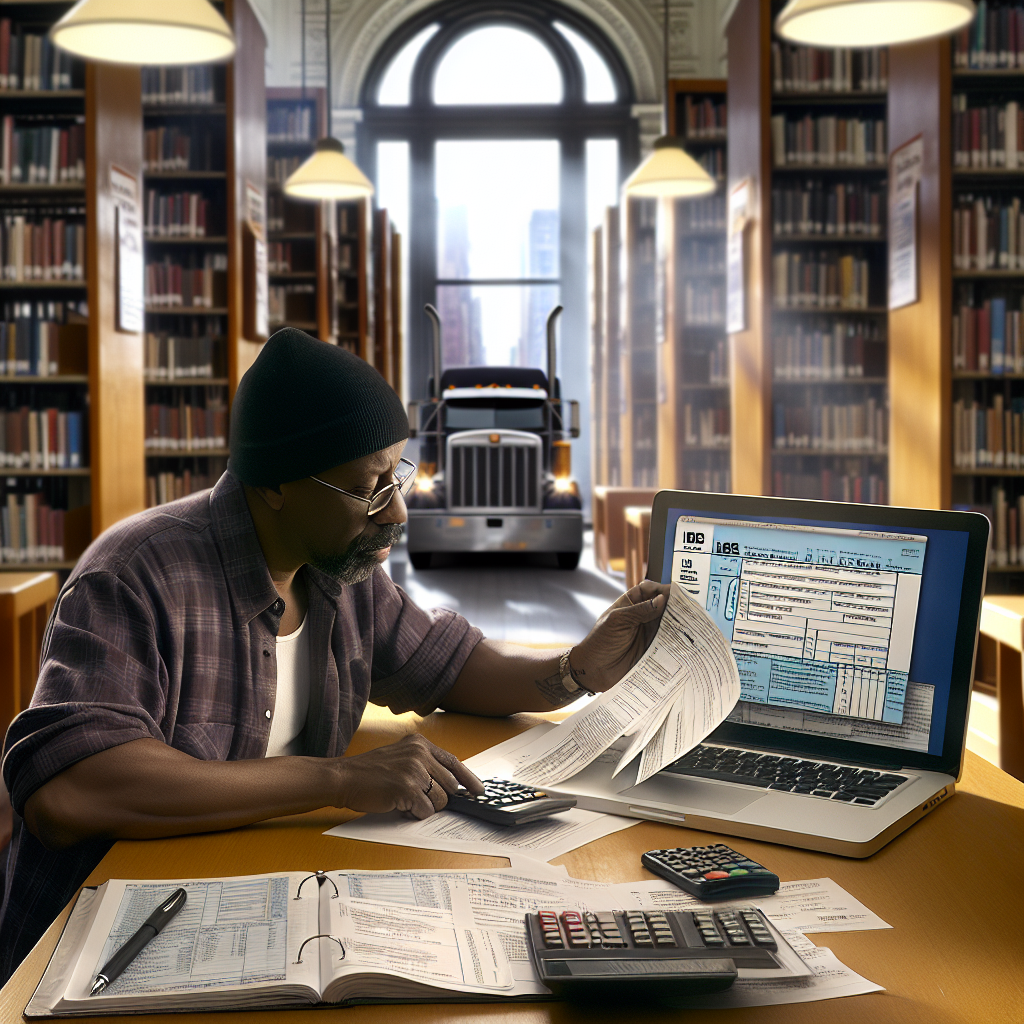

Owner-operators and small fleets in New York City have a low-cost way to get through tax season: Single Stop’s free, IRS-certified income tax preparation sessions at the New York Public Library’s Harlem Library. Appointments run on Saturdays—March 7, 14, 21, and 28, 2026—from 10 a.m. to 2 p.m., and the branch is wheelchair accessible. ASL interpretation and real-time captioning are available by request at least two weeks in advance. Advance registration is required.

These sessions are part of a nationwide network of IRS partner sites where certified preparers deliver basic return prep at no cost to qualifying filers. Volunteers must pass IRS tax law training and every return gets a quality review—useful reassurance for truckers dealing with Schedule C income, 1099-NECs from brokers, and complex expense logs.

Eligibility in NYC and what self‑employed truckers should know

If you live or work in NYC, check the city’s current income thresholds for free prep. For the 2025 tax year (returns due in 2026), NYC Free Tax Prep indicates in-person assistance for many filers up to $97,000 with dependents and $68,000 without dependents, with program details and offerings updated as the filing season opens. Some NYC sites also support self‑employed taxpayers—such as owner-operators—with business expenses up to $250,000; availability varies by site, so confirm before booking.

Key deductions and 2026 numbers for the road

Meals: Truckers can use the transportation industry special per diem for meals and incidental expenses (M&IE) instead of saving every receipt. For the period covering late 2025 into 2026, the IRS special M&IE rates are $80 per day within the continental U.S. and $86 outside CONUS. Remember, the meals portion remains subject to the standard deduction limitation under Section 274.

Vehicle use: If you deduct mileage rather than actual expenses, the IRS business standard mileage rate increases to 72.5 cents per mile beginning January 1, 2026. Keep contemporaneous logs from your ELD or trip sheets to substantiate business miles.

What to bring to your appointment

Showing up prepared speeds your appointment and reduces the risk of missed deductions common in trucking. In addition to a government ID, Social Security cards/ITINs, and last year’s return, gather:

- Income: 1099-NEC from brokers/carriers; any W-2s; settlement statements; interest/dividend forms if applicable.

- Business records: ELD or paper logs; mileage logs (if using standard mileage); fuel, toll, parking, repair, tire, and maintenance receipts; scale tickets; factoring fees; insurance and permits.

- Asset details: In-service dates and cost for tractors, trailers, APUs, and major equipment (for depreciation/Section 179 and records of prior-year depreciation schedules).

- Travel substantiation: Per diem days away from home, dispatch records, and bill of lading dates that align to time on the road.

- Bank information for direct deposit and any IRS/state letters received.

How to book and prepare

Because the Harlem Library sessions require an appointment, book early—especially if you need language access or ASL/CART accommodations. Read the site’s eligibility notes and bring the documents listed above so an IRS-certified preparer can complete your return efficiently. If your return is outside the site’s scope (for example, certain complex business situations), staff can advise on alternatives.

Bottom line for fleets and drivers

For many NYC-based or NYC-hauling owner-operators, free, IRS-certified tax prep can cut filing costs and help capture deductions you might otherwise miss—especially per diem and properly tracked vehicle expenses. Fleet managers should share this option with company drivers who have side 1099 income, as well as lease-operators, to reduce compliance risk and support accurate, timely filings. Between the Harlem Library’s March Saturday schedule and other NYC Free Tax Prep partners citywide, there are multiple ways to get legitimate, no-cost help this season.

Editor’s note: Dates in this article refer to March 2026 event sessions (Saturdays, March 7, 14, 21, 28, 10 a.m.–2 p.m.), and the mileage/per diem figures are for the 2026 tax year where noted. Always confirm site-specific eligibility and scope before you go.

Sources Consulted: The New York Public Library; Internal Revenue Service (VITA/TCE; standard mileage; IRB per diem); NYC Department of Consumer and Worker Protection/ACCESS NYC; Ariva (NYC VITA provider checklist).

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.