What’s happening at Harlem Library

Owner-operators and fleet managers in New York City can book no-cost, IRS-certified income tax preparation at the New York Public Library’s Harlem Library on four Saturdays in March 2026 (March 7, 14, 21, and 28), from 10 a.m. to 2 p.m. The program, delivered by Single Stop, is in-person, wheelchair accessible, and requires an appointment. ASL interpretation and real-time captioning are available with advance request. For independent truckers juggling tight schedules, the weekend hours and vetted preparers make this a practical option to get 2025 returns filed accurately.

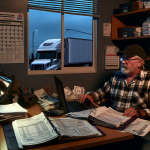

Who it’s for—and why it matters to truckers

Single Stop’s tax prep at NYPL is an IRS-certified and supervised program—think VITA/TCE-style assistance that emphasizes accuracy, quality review, and privacy safeguards. That structure can be especially valuable if you’re an owner-operator navigating 1099 income, fuel and maintenance deductions, or per‑diem meal allowances. The IRS notes that VITA/TCE sites are staffed by trained, certified volunteers and that services vary by site, so confirm in advance that your Schedule C situation is within scope.

Beyond this library event, NYC’s Free Tax Prep initiative now includes resources tailored to self‑employed filers—gig workers, freelancers, and small business owners—covering annual returns and help with quarterly estimated taxes. For the 2026 filing season (2025 tax year), DCWP lists expanded eligibility and a self‑employed/Schedule C assistance track for filers with up to $250,000 in business expenses, a meaningful threshold for many truck businesses.

What owner‑operators should bring

To keep your appointment efficient, assemble documents the IRS recommends for VITA/TCE visits—and add trucking‑specific records to maximize legitimate deductions:

- Government-issued photo ID; Social Security cards (or ITIN letters) for you, spouse, and dependents; and birthdates.

- All income forms: 1099‑NEC/1099‑K from brokers and load boards; W‑2s if applicable.

- Direct‑deposit details (routing and account numbers) for faster refunds.

- Mileage and expense logs: ELD trip reports, fuel receipts, scale tickets, tolls, parking, maintenance/repairs, tires, insurance, permits, and lease or loan statements.

- Records that substantiate travel days and on‑the‑road meals if claiming the special transportation per‑diem; your bookkeeper’s ledger or accounting app exports.

- Last year’s federal and state returns to help verify carryovers and settings (e.g., depreciation schedules).

Note: VITA/TCE sites follow IRS scope rules. Some complex items—like depreciation on multiple units, inventory, or business losses—may be out of scope; ask the site about Publication 3676‑B “what we can do” lists when you schedule.

Key 2026 dates for your calendar

For 2025 returns, Tax Day is Wednesday, April 15, 2026. If you need more time to file, you can request an automatic extension to October 15—just remember that any tax due must still be paid by April 15 to avoid penalties and interest. Self‑employed truckers should also plan for quarterly estimated payments in 2026: April 15, June 15, September 15, and January 15, 2027.

Why this is a smart stop for fleets and O/Os

Margins are tight, and tax missteps are expensive. An IRS‑certified appointment at a neighborhood library is a low‑friction way to: ensure your Schedule C is prepared correctly; verify that deductions like equipment, repairs, and allowable per‑diem are captured; and line up a plan for 2026 estimated payments. NYC’s self‑employed‑focused resources add year‑round support—from record‑keeping workshops to guidance on quarterly taxes—so you can stay compliant without pulling your rig off the road longer than necessary. Pair that with e‑file and direct deposit for quicker refunds, and this March series at Harlem Library becomes a high‑ROI pit stop before spring shipping ramps up.

Bottom line: Book an appointment, bring thorough records, and leverage NYC’s expanded self‑employed tax help. Getting 2025 taxes right by April 15 sets you up to reinvest in equipment, cover rising insurance, and keep your trucks rolling without tax surprises mid‑year.

Sources Consulted: The New York Public Library; Internal Revenue Service; NYC Department of Consumer and Worker Protection; AARP.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.