What’s new: E‑file processing starts January 26, 2026

The 2026 filing season is officially underway. As of Monday, January 26, 2026, both the Oregon Department of Revenue and the IRS are accepting and processing electronically filed individual income tax returns for tax year 2025. Oregon officials say the first wave of state refunds could arrive as soon as February 17 for e‑filers using direct deposit. Paper returns will be processed later and refunded much more slowly this year due to back‑end configuration delays, so electronic filing is strongly encouraged.

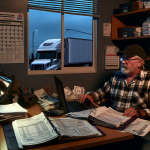

Why it matters to trucking

Cash flow and paperwork tend to collide for carriers in Q1. For owner‑operators and small fleet managers, getting returns in early—and correctly—helps you line up funds for Q2 maintenance, plates, insurance renewals, and spring freight ramp‑ups. In Oregon, there’s an added incentive: the state’s “kicker” credit, a surplus refund calculated as a percentage of your 2024 Oregon tax liability and delivered through your 2025 state return. If you had Oregon‑source income in 2024 and file an Oregon 2025 return, the kicker could boost your refund or reduce tax due. Filing electronically with direct deposit is the fastest path to receive it.

Key dates you should lock in now

- January 26, 2026: Opening day for e‑file processing at both Oregon and the IRS.

- February 17, 2026: Earliest expected date for Oregon e‑filed refunds to land via direct deposit.

- April 15, 2026: Federal and Oregon filing deadline for most individuals; also the due date for 2026 first‑quarter federal estimated tax.

- Estimated tax cadence for TY2026 income: April 15, June 15, September 15, 2026, and January 15, 2027 (if required). If you file your 2026 return and pay in full by early February 2027, you may not need the January installment.

Owner‑operator and fleet checklist for a smoother season

- Reconcile mileage, per‑diem, and logs: Align ELD trip records, dispatch summaries, and per‑diem claims. Consistency across logs, fuel receipts, and tolls helps avoid refund delays if your return is pulled for review.

- Close out 1099s and settlements: Match broker and shipper 1099‑NEC/1099‑K forms to carrier settlement reports and bank deposits. Track any accessorials (detention, lumper reimbursements) that could affect income or expense classification.

- Document equipment activity: Keep purchase invoices, financing statements, and placed‑in‑service dates for tractors, trailers, and APUs. Accurate records support depreciation and Section 179 elections, as applicable.

- Inventory maintenance and parts: Many shops saw price swings in 2025; ensure parts and tire purchases are captured. Break out capitalizable rebuilds versus routine repairs.

- Standardize driver reimbursements: For fleets, spell out accountable plan rules for driver reimbursements (meals, lodging, cell/data). Clean policies reduce mismatches that can slow processing or trigger notices.

- File electronically and choose direct deposit: Oregon expects slower processing for paper returns this year. E‑file with direct deposit is the quickest route to both Oregon refunds and the state kicker credit.

Oregon “kicker” tips for truckers

The kicker isn’t a separate check—it’s a refundable credit claimed on your Oregon return. Only taxpayers who filed a 2024 Oregon personal income tax return and also file a 2025 return can receive it. If you had Oregon‑source income as a nonresident (for example, an owner‑operator running dedicated lanes through Oregon), you may still qualify when you file. Use the state’s calculator through Revenue Online to verify your amount before filing, and verify that your 2024 filing status and SSN entries match what the calculator expects.

Refund timing expectations

For Oregon e‑filers with direct deposit, plan on roughly two weeks from acceptance in ordinary cases—Oregon’s first deposits are expected on or after February 17. Paper returns won’t see movement until late March, with refunds beginning in early April. For federal returns, timing varies based on accuracy and whether your return triggers identity or wage‑verification checks; e‑file plus direct deposit generally speeds things up.

Final mile: avoid avoidable delays

- Names, SSNs/EINs, and bank info must be exact; mismatches derail direct deposits.

- Double‑check routing/account numbers for business accounts if refunds are going to an operating account.

- If you owe, schedule an ACH debit on April 15, 2026, to preserve cash until then—and still avoid late‑payment penalties.

- Set your 2026 estimated payments with seasonality in mind; annualize if freight is lumpy rather than level across quarters.

Bottom line for fleets and O/Os: File electronically, use direct deposit, and square up your logs, settlements, and equipment records now. If Oregon is in your tax picture, the kicker can improve cash flow—but only if you file an accurate return.

Sources Consulted: Oregon Department of Revenue; Internal Revenue Service; Oregon Association of Tax Consultants.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.