What’s happening and when

Tax season is officially underway. The Internal Revenue Service and the Oregon Department of Revenue began accepting and processing electronically filed returns on January 26, 2026. For Oregon filers, the agency also flagged that first refunds from e‑filed returns are expected to go out beginning February 17, while paper returns won’t see refunds until early April due to processing delays. The standard filing deadline this year is Wednesday, April 15, 2026.

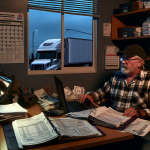

Why this matters to trucking businesses

For owner‑operators and small fleets that file as sole proprietors, partnerships, or S‑corps, e‑filing with direct deposit is the fastest route to a refund—cash that can help cover Q1 expenses like insurance, PMs, and tire purchases. Oregon also reminds residents that the “kicker” credit—estimated at $1.41 billion statewide—will only be paid through the 2025 return, not by separate check. If you filed an Oregon return for tax year 2024 and file again for 2025, the kicker shows up as a refundable credit on your 2025 state return.

Action checklist for owner‑operators and fleet managers

- Close out 2025 income and expenses. Reconcile settlement statements, ELD mileage, fuel receipts, tolls, lumper fees, and maintenance records so your Schedule C (or business return) is complete and defensible.

- Capture big-ticket deductions. Coordinate with your tax pro on equipment purchases, repairs vs. capital improvements, and current‑year limits for Section 179 and bonus depreciation—especially if you added tractors, trailers, or APUs.

- Match mileage systems. Ensure IFTA/ELD/Oregon mileage all reconcile to prevent state audit issues and to support depreciation/use tax positions.

- E‑file and use direct deposit. It’s the quickest path to refunds at both IRS and Oregon; paper filings will run slower than usual this year.

- Leverage free filing options if eligible. IRS Free File opened earlier in January to let qualified taxpayers prepare returns and queue them for e‑file once the season opened. Check eligibility and consider using guided software if you don’t need full service from a preparer.

Oregon‑specific reminders for carriers

Oregon’s weight‑mile tax remains separate from your income tax return. If your combination weight exceeds 26,000 pounds in Oregon, you must be enrolled in the Weight‑Mile Tax Program or use appropriate temporary credentials, track in‑state miles, and file reports with the Commerce and Compliance Division (CCD). Review your account status, declared weights, and reporting cadence before peak hauling ramps up.

Federal trucking tax essentials to keep on your radar

- Heavy Vehicle Use Tax (HVUT). The current Form 2290 period runs July 1, 2025 through June 30, 2026. If you placed a 55,000‑lb+ vehicle in service during this period, Form 2290 is due by the last day of the month following first use. Keep your IRS‑stamped Schedule 1 on file for registration.

- Who must e‑file Form 2290. If you’re reporting 25 or more taxable vehicles, the IRS requires e‑filing; everyone else is strongly encouraged to e‑file to get Schedule 1 faster.

Tips to speed refunds and cut risk

- File early if you’re due a refund. E‑file with direct deposit and double‑check routing/account numbers.

- Validate 1099‑NEC/1099‑K and W‑2 totals against your books before submitting returns to avoid mismatch notices.

- Use consistent odometer and ELD data across IFTA, Oregon weight‑mile, and federal depreciation schedules.

- Document per diem and lodging for days away from home. Keep logs that tie to routes, delivery dates, and receipts.

- Watch for identity‑theft scams targeting carriers during filing season; use official .gov sites and verified providers only.

Bottom line: With the IRS and Oregon both processing e‑filed returns as of January 26, 2026, this is the moment to button up records, coordinate with a knowledgeable preparer, and leverage e‑filing to keep cash flowing and compliance tight through the spring rush.

Sources Consulted: Oregon Department of Revenue; Internal Revenue Service (IRS); Oregon Department of Transportation (Commerce and Compliance Division).

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.