Key 2026 refund dates at a glance

For most filers who e‑file accurately and choose direct deposit, the IRS still targets “about 21 days” to issue refunds. However, by law, refunds that include the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) cannot be released before mid‑February; the IRS says most of those early EITC/ACTC refunds should be available around March 2, 2026, with personalized deposit dates showing up in Where’s My Refund? by February 21. Weekends and bank holidays can still push funds availability by a day or two.

Why some refunds arrive later—even if you filed early

There is no single “refund day.” Returns move through acceptance, matching, and verification steps on a rolling basis. Any mismatch (for example, income or withholding that doesn’t line up with employer or 1099 data), missing information, or identity‑theft flags can push a return into manual review and extend timelines beyond the 21‑day norm. Paper‑filed returns also take longer to process than e‑filed returns.

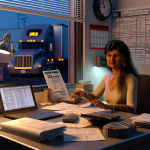

What this means for owner‑operators and small fleets

For trucking businesses that live and die by cash flow, refund timing affects equipment repairs, insurance renewals, and fuel budgeting. Keep in mind:

- E‑file with direct deposit to the business account you actually use for operating expenses; don’t risk delays with paper checks.

- Expect extra scrutiny if you report substantial nonemployee compensation (Forms 1099‑NEC/1099‑K), claim large fuel, per‑diem, or depreciation deductions, or amend prior returns—any of these can slow processing while the IRS validates data.

- If your return includes EITC/ACTC (common for lower‑to‑moderate‑income households), plan around the statutory hold: most early filers who meet the IRS criteria won’t see funds until late February or the first days of March.

2026 timing guide: realistic expectations

- E‑file + direct deposit, no issues: often under 21 days from IRS acceptance.

- Paper return or returns routed for manual review: several weeks longer than e‑file; amended returns take much longer.

- EITC/ACTC refunds filed early: Where’s My Refund? typically shows dates by Feb. 21; many deposits land by about Mar. 2, 2026 (bank posting practices can add a day or two, especially around Presidents’ Day on Monday, Feb. 16).

How to avoid delays this season

- Match your numbers: Reconcile your 1099‑NEC/1099‑K totals, mileage logs, and settlement statements before filing to reduce mismatch flags.

- File electronically and use direct deposit: It’s the fastest route for both individuals and sole proprietors filing Schedule C.

- Enter bank info carefully: A transposed account or routing number can trigger a refund trace and weeks of delay.

- Respond promptly to IRS letters: If the IRS requests verification or documents, answer quickly to restart processing. Check Where’s My Refund? once daily; it updates overnight.

If your refund is late: the playbook

- Start with Where’s My Refund? or the IRS2Go app for status; don’t call before 21 days (e‑file) or six weeks (paper) unless the tool instructs you.

- If the IRS shows “refund sent” but you don’t see it, ask for a refund trace after allowing for bank posting time and holidays.

- Hardship and offsets: TAS notes the IRS can sometimes expedite refunds only in narrow hardship cases and generally not for non‑tax debt offsets (e.g., child support). Plan operating cash accordingly.

Bottom line for trucking cash flow

For most owner‑operators and fleet managers, count on roughly three weeks for a clean e‑filed return with direct deposit, but build February slack into your budget if you claim EITC/ACTC or have complex business schedules. Early filing helps, yet accuracy and e‑file with direct deposit matter far more for keeping trucks—and refunds—moving.

Sources Consulted: Internal Revenue Service (IRS newsroom, EITC refund timing and Where’s My Refund? guidance); Taxpayer Advocate Service (refund timing, PATH Act holds, refund traces); HexaCureHospital.in overview on refund processing and common delay factors.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.