Key dates: Filing is open and Tax Day is April 15, 2026

The IRS began accepting 2025 individual returns on January 26, 2026, with Tax Day set for Wednesday, April 15, 2026. E-filing with direct deposit remains the fastest route to a refund, and most refunds are issued within about 21 days for error‑free, e‑filed returns. If you need more time to file, you can request an extension by April 15; that gives you until October 15, 2026 to file, but any tax due must still be paid by April 15 to avoid interest and penalties.

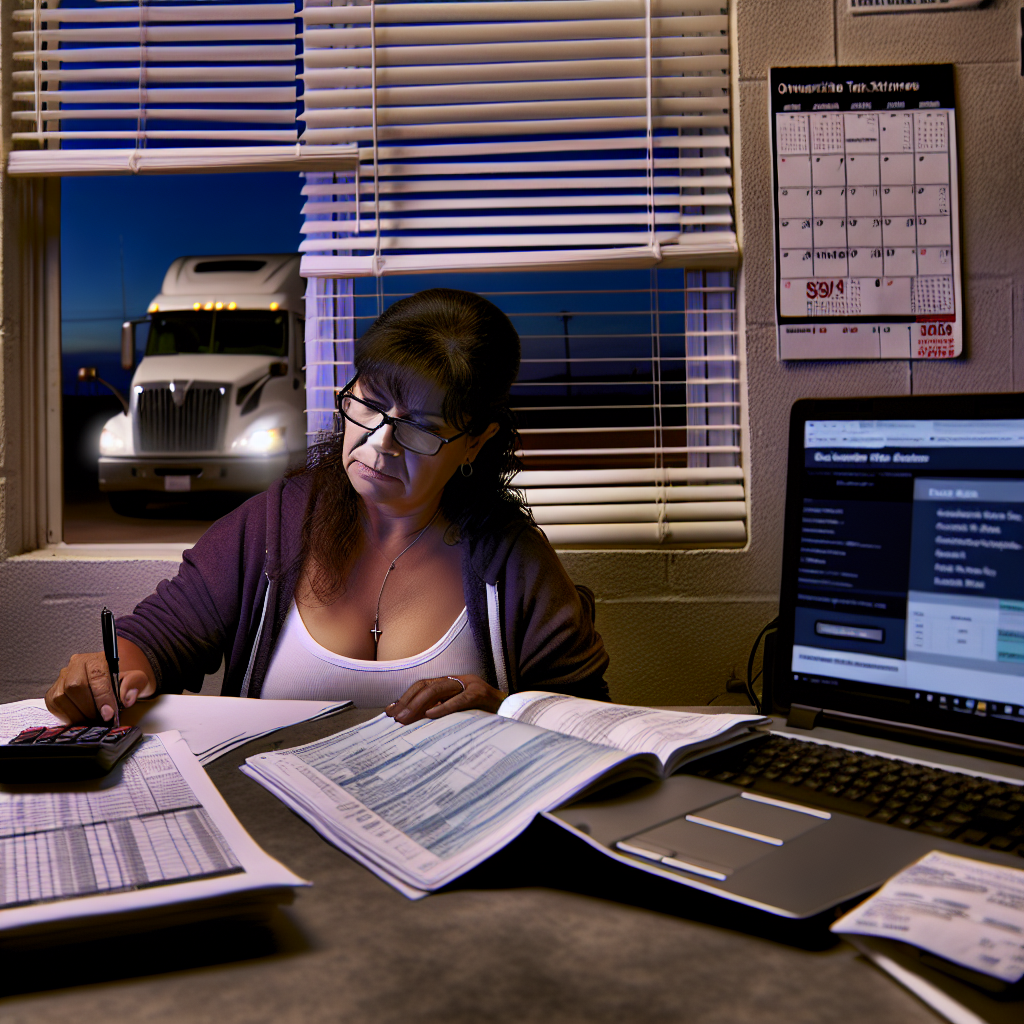

AI for taxes: Helpful copilot, not an autopilot

AI tools are increasingly part of tax season. Recent surveys suggest roughly one in five Americans plan to use AI to help with filing this year, with adoption highest among younger filers. That aligns with broader findings that consumers are turning to generative AI for financial guidance—especially explanations and checklists. Treat AI as a research and organization aid, then confirm next steps against official IRS instructions or with a qualified tax professional before you file.

Trucker-specific deductions you don’t want to miss

- Meals on the road (80% rule): If you’re subject to DOT hours-of-service limits, you can generally deduct 80% of business meal costs while away from home. You may use the transportation industry per diem instead of actual meal costs. Keep logs to substantiate days away (ELD, dispatch records, receipts as needed).

- Transportation per diem rates: For travel on or after October 1, 2025, the special M&IE per diem for transportation workers is $80 per day within the continental U.S. (CONUS) and $86 outside CONUS. Remember, per diem covers meals and incidentals, not lodging.

- Mileage vs. actual expenses: Owner‑operators typically choose the actual‑expense method (fuel, maintenance, insurance, lease payments, depreciation) because a Class 8 tractor’s costs exceed passenger‑car norms. If you do track mileage for business vehicles eligible for the standard rate, use the correct calendar‑year rate: for 2025 miles (claimed on 2025 returns filed in 2026) the business rate is 70.0¢/mile; for 2026 planning, the rate rises to 72.5¢/mile. You can’t switch freely between methods for the same vehicle without following IRS rules.

- Driver reimbursements and accountable plans: Fleets reimbursing employee drivers should ensure their per diem and travel reimbursements are under an accountable plan to avoid taxable wages and payroll‑tax surprises. (AI can draft checklists for required elements, but verify with a CPA.)

- Other common write‑offs: Licensing and permits (IRP), IFTA taxes and fees, tolls, scales, truck washes, communication devices used for business, personal protective gear, and interest on business loans. When in doubt, document the business purpose and keep receipts.

Owner-operator checklist to speed refunds and cut errors

- Match your 1099-NEC/1099-K totals from brokers and load boards to your books before filing.

- Reconcile fuel and maintenance via settlement statements and bank/credit card records; fix mismatches now.

- Separate business and personal expenses; mixed-use items (like phones) need reasonable allocation.

- Use e-file and direct deposit to reduce processing time and mailing risk.

Where AI fits into a trucker’s workflow

AI can quickly explain deductions (for example, how the 80% meal rule applies), generate tailored checklists (documents, per‑diem day counts, quarterly estimated tax reminders), and flag inconsistencies in your bookkeeping exports. It can also summarize IRS instructions in plain English. But AI can miss context—like whether a day qualifies as “away from home,” or when per diem is preferable to actuals—so make it a first pass, not the final word. When stakes are high (equipment purchases, depreciation elections, multi‑state filings), loop in a tax pro.

A few planning notes for 2026

- Per diem and 80% meal rule: The special transportation per diem and 80% deduction remain key benefits for drivers under HOS rules; build your 2026 recordkeeping around them.

- Mileage budgeting: If you run light‑duty vehicles in your operation, note the 2026 business mileage rate is 72.5¢/mile—useful for cost projections even if you’ll ultimately deduct actuals.

Bottom line: Tax season officially kicked off January 26, 2026, and April 15 will be here fast. AI can help owner‑operators and fleet managers organize, but the gold standard is still accurate records, IRS‑aligned rules, and a knowledgeable tax pro to keep your rig—and your return—between the lines.

Sources Consulted: Realtor.com (Facebook page), IRS.gov, Forbes, NYSSCPA, AP News.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.