What’s on the board today

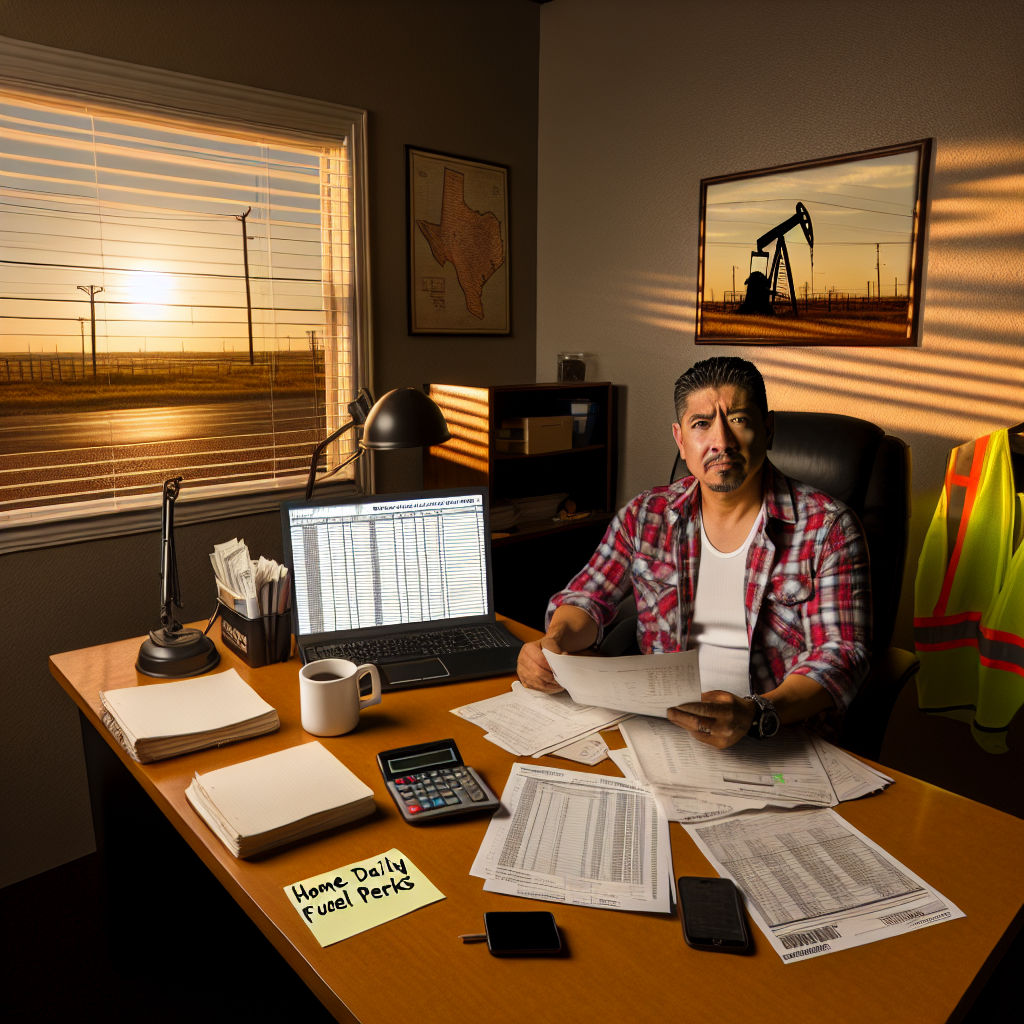

Texas remains a hotbed for crude and energy-adjacent hauling, with more than 200 owner-operator postings statewide on Indeed as of October 4, 2025. Pay ranges advertised this week include $3,000–$6,000 per week for crude oil haulers in Dilley and Midland, and a Dallas-based “home daily” flatbed/pneumatic opportunity listing average gross revenue of $5,600 per week ($290,000 annually). Trimac’s Wink posting notes 64% of linehaul with weekly gross estimates of $3,800–$4,200, while several West Texas roles flag night shifts and local turns. These are posted ranges and gross figures; net take-home depends on expenses and utilization.

Perks, deductions, and the fine print showing up in ads

- Fuel cards and fuel discounts are common, as are paid tolls on select lanes.

- Several ads highlight IRS‑approved per diem plans, which can improve after‑tax income when structured correctly.

- Some postings offer housing or housing assistance near remote bases (e.g., Mentone), plus insurance options and referral bonuses.

Read the details closely: one Texas tanker carrier explicitly lists an IRS‑approved per diem, multiple postings include fuel cards/discounts, and at least one crude carrier advertises paid housing for drivers near Mentone.

Where the loads are—and what’s required

Most activity clusters in the Permian corridor (Winkler, Pecos, Midland, Mentone) with some Eagle Ford footprints (Dilley/Cotulla) and metro freight options (Dallas, Houston). Common requirements include current CDL‑A, tanker and often HazMat endorsements, a clean MVR, prior tanker or oilfield experience, and your own tractor. Several listings stress night availability and “home daily” cycles, reflecting short-haul lease-to-station crude runs and local sand moves.

Market backdrop: strong baseline volumes, softer price outlook

Texas production totals through mid‑2025 remain elevated by historical standards, underscoring why West Texas continues to generate steady local energy freight. The Railroad Commission’s monthly data for January–June 2025 show high statewide output, with July preliminary figures (typically revised upward) still robust—supporting a base layer of crude and sand hauling demand even as individual fields ebb and flow.

Looking ahead, the U.S. Energy Information Administration expects oil prices to trend lower on inventory growth, with Brent averaging around the high‑$60s in 2025 and easing in 2026. EIA also projects U.S. crude output to edge down from record levels as producers respond to prices and a lower rig count. For owner‑operators, that can translate to more competition for barrels in a given basin and greater scrutiny on rates and turn counts—even if local production remains high by historical norms.

What to ask before you sign

- Rate basis: percentage of linehaul, per‑barrel, or flat per‑load? Clarify fuel surcharges and accessorials.

- Average turns per day and typical wait times at leases/pipeline stations; detention and demurrage policies in writing.

- Who pays for hoses, fittings, pump/air systems, washes, and heels disposal? Any trailer rent or usage fees?

- Insurance: cargo, liability, bobtail, OCC/ACC; confirm deductibles and what’s company‑provided vs. owner‑paid.

- Per diem treatment on settlements; other deductions (escrow, plates, IFTA, ELD, parking).

- Equipment standards, maintenance intervals, and 24/7 dispatch/roadside support.

- Lane geography, home‑time reality, and whether “home daily” assumes night shifts or split weeks.

Bottom line

For Texas owner‑operators, the job board shows plentiful opportunities this week—especially around the Permian—with advertised gross in the $3,000–$6,000 range, plus a handful of higher‑gross sand roles and home‑daily options in major metros. With fuel discounts, per diem programs, and paid tolls showing up in postings, the package can be compelling. Just remember the macro: if prices soften and operators trim activity, utilization and rates can tighten. Lock in clear terms on rate basis, accessorials, and turn expectations so your weekly gross translates to reliable net income.

Sources Consulted: Indeed; Texas Railroad Commission; U.S. Energy Information Administration.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.