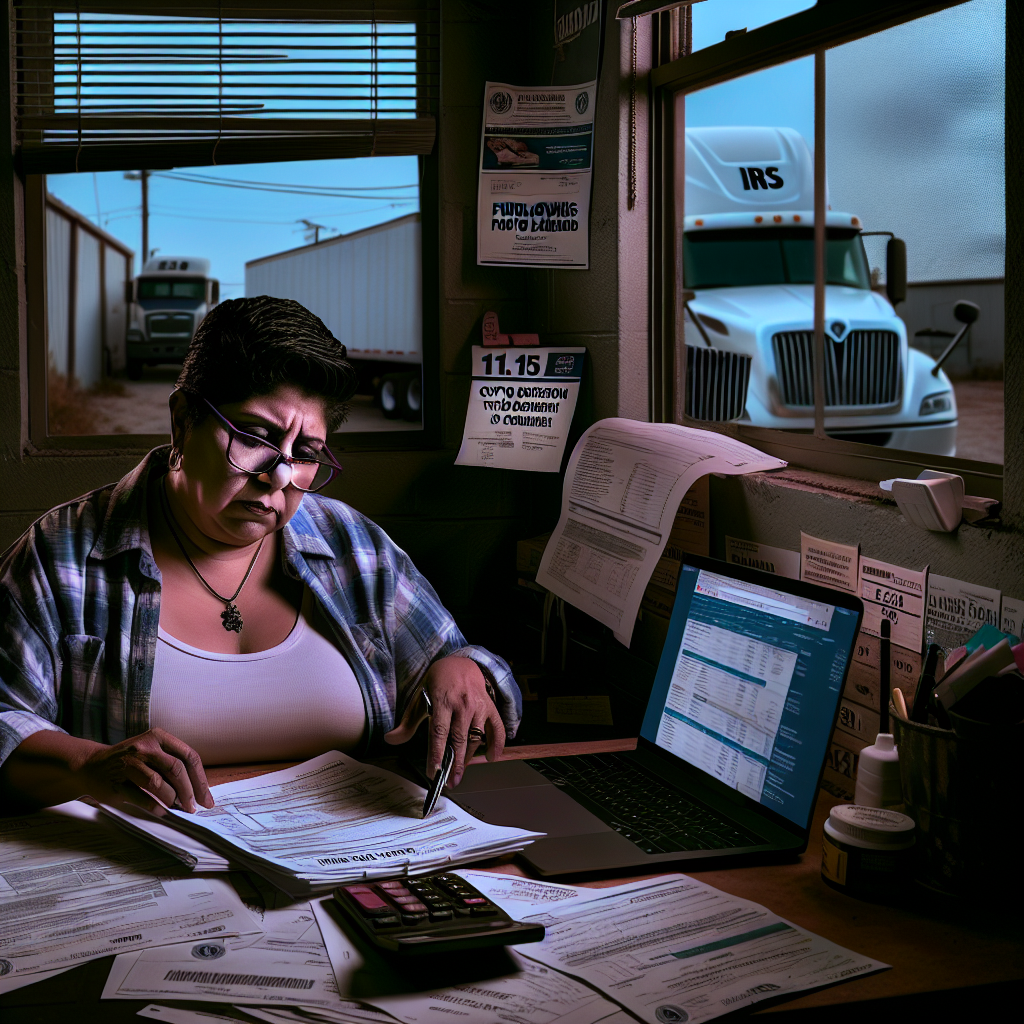

What’s happening at the IRS right now

The federal government shutdown that began on October 1, 2025, has now forced the Internal Revenue Service to furlough a large share of its workforce. After operating for five business days using Inflation Reduction Act funding, the IRS initiated an agency-wide furlough on October 8 for all but “excepted” and “exempt” staff. Trade publications and IRS communications indicate roughly 34,000 employees — about 46% of the workforce — were sent home, with most live taxpayer services paused. Essential functions such as limited IT operations, statute protection, some revenue collection, and criminal enforcement continue.

The shutdown is in its second week and arrives just ahead of the October 15 extension deadline for individuals and calendar-year C‑corporations. The IRS had advised on October 1 that taxpayers should continue to meet all filing and payment obligations; that message still applies despite service disruptions.

Why owner-operators and fleets should care about crypto taxes

Plenty of truckers dabble in crypto — whether investing between loads, accepting tokens through rewards programs, or experimenting with digital payments. The shutdown does not change your tax obligations. If you traded or used digital assets in 2024 or 2025, you must still report income and gains as usual, even if it’s harder to get IRS help this week.

At the same time, the U.S. crypto reporting framework is entering a new phase. Treasury and the IRS finalized “broker” reporting rules that phase in over multiple years and introduce Form 1099‑DA. In general: brokers must report gross proceeds from customers’ digital asset sales for transactions effected in 2025, and basis reporting phases in for certain sales in 2026, with transitional penalty relief for 2025 if firms make good‑faith efforts. That means many taxpayers will start seeing new crypto tax forms in early 2026 for 2025 transactions — regardless of today’s staffing cuts.

Industry watchers also warn that with fewer IRS staff available during the shutdown, some near‑term guidance and troubleshooting around digital assets could lag. A Senate hearing just last week underscored that both industry and the IRS face implementation headaches as the reporting surge arrives.

Practical steps for trucking businesses

- File and pay on time. The October 15, 2025, deadline remains in force for those on extension; there’s no automatic grace period because of a shutdown. E‑file if possible to avoid paper delays.

- Expect reduced service. IRS phone lines and many taxpayer assistance functions are curtailed. The Taxpayer Advocate Service has also indicated closures during shutdowns, so plan for slower responses on open cases.

- Keep meticulous crypto records. Track dates, amounts, wallet/exchange details, and business versus personal use for every transaction. Those records will be vital when 1099‑DA statements begin arriving for 2025 activity and when basis reporting expands in 2026.

- Watch for new forms in early 2026. If your drivers or your business account traded on custodial exchanges in 2025, expect Form 1099‑DA showing gross proceeds. Brokers have transitional relief on penalties for 2025 reporting, but your duty to report income doesn’t change.

- Plan for audits later. Many civil audits and non‑automated collections may pause during a shutdown, but enforcement doesn’t disappear, and criminal investigations continue. Don’t assume inactivity equals leniency.

- Coordinate with your tax pro. If you run a fleet or file as a sole proprietor, alert your preparer now about any crypto trades or payments tied to the business (for example, rewards, vendor payments in tokens, or mining/staking done with company assets).

Bottom line for trucking

For owner‑operators and fleet managers, the immediate impact of the shutdown is slower service, not a change in the rules. Keep your October 15 filings on track, continue estimated tax payments, and tighten crypto recordkeeping. Looking ahead, the digital‑asset reporting regime is moving forward on the IRS’s timeline: 2025 transactions lead to new 1099‑DA forms in early 2026, with deeper basis reporting after that. A temporary pause in IRS staffing won’t pause your obligations — or the data trails that will flow when broker reporting ramps up.

Sources Consulted: Journal of Accountancy; Accounting Today; Reuters; Associated Press; Bloomberg Law; Internal Revenue Service (newsroom, instructions for Form 1099‑DA, and notices); CoinDesk.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.