Why this matters to trucking

Owner-operators and fleet managers are staring down crucial year-end tax choices. The IRS has raised the transportation per diem, confirmed 2025 mileage rates, and set inflation-adjusted Section 179 expensing limits—while Form 2290 (HVUT) deadlines and quarterly estimated tax dates march on. Here’s a practical, trucking-focused rundown so you can lock in deductions, stay compliant, and avoid penalties.

Per diem for drivers: higher rates, same 80% deductibility

Effective for travel beginning October 1, 2025 (FY 2025–2026), the special transportation industry meals and incidental expenses (M&IE) per diem rises to $80 inside the continental U.S. (CONUS) and $86 outside CONUS. Drivers subject to DOT hours-of-service rules can still deduct 80% of eligible meals. Make sure logs and trip records substantiate days away from home and that your payroll/accounting systems reflect the new rate from October trips forward.

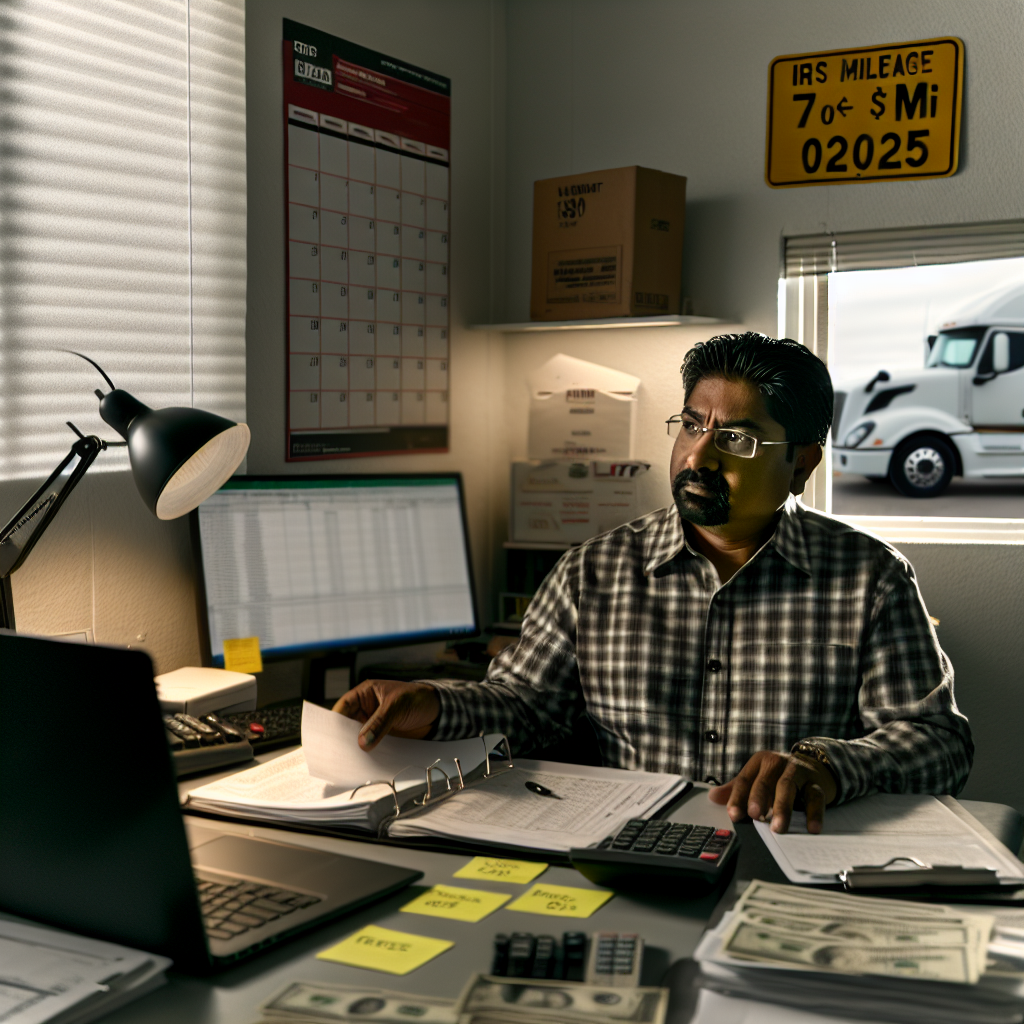

Mileage rate: useful for light-duty support vehicles, not tractors

The optional standard mileage rate increases to 70 cents per mile for business use beginning January 1, 2025. This rate applies to cars, vans, pickups, and panel trucks—handy for supervisors, parts runners, and sales/service vehicles in a fleet. Most Class 8 tractors and specialized heavy trucks aren’t eligible for the mileage method, so those should continue using actual expenses.

Big-ticket buys: Section 179 and bonus depreciation in 2025

If you’re weighing a truck, trailer, shop equipment, or technology purchase before year-end, note these limits for tax years beginning in 2025: the Section 179 expensing cap is $1,250,000, with a phase-out starting at $3,130,000; the first-year SUV cap is $31,300. Bonus depreciation remains available, but the 168(k) “bonus” percentage is 40% for qualified property placed in service in 2025 under current law. Plan purchases and in-service dates accordingly, and model cash taxes vs. book depreciation before you sign.

HVUT (Form 2290): what to do if you missed the main deadline

The current 2290 tax period runs July 1, 2025–June 30, 2026. For vehicles first used in July 2025, the filing/payment deadline was September 2, 2025 (since Aug. 31 fell on a weekend). If you put additional units into service after July, the tax is prorated and due by the last day of the month following first use (for example, October first use is due December 1, 2025). Late filers should act now to avoid escalating penalties and registration issues.

1099-K: platform-pay thresholds truckers using apps should know

If you occasionally get paid via marketplaces or payment apps (for side hauling, parts resales, or services), remember the IRS transitional thresholds: more than $5,000 for 2024 and more than $2,500 for 2025, before the statutory $600 kicks in later under current guidance. Keep clean records to match any 1099-Ks you receive.

Quarterly estimated taxes: dates to circle

For self-employed truckers on a calendar year, the remaining 2025 estimated tax cadence is September 15, 2025 (Q3) and January 15, 2026 (Q4). Paying on time helps you avoid underpayment penalties; farmers and fishers have special one-payment rules.

Five quick moves before year-end

- Update T&E policies to the $80/$86 transportation per diem for trips on/after October 1, 2025; ensure 80% deductibility is applied for drivers under DOT HOS.

- Assign the 70¢ mileage rate to eligible light-duty support vehicles starting January 1, 2025; keep using actuals for tractors and heavy units.

- Model equipment buys using Section 179 first, then bonus depreciation; verify in-service dates and state conformity before committing.

- Audit HVUT compliance for any units first used after July; file Form 2290 for each month’s additions by the following month’s end.

- If you’re paid via apps/marketplaces, monitor 1099-K thresholds and reconcile gross receipts to your books to avoid surprises at filing time.

Bottom line for fleets and O/Os: Small adjustments now—per diem, mileage, and capitalization policies—can prevent penalties and free up cash at tax time. Coordinate early with your tax pro so deductions match the realities of your routes, rigs, and replacement cycles.

Sources Consulted: IRS Internal Revenue Bulletin 2025-41 (per diem); IRS Newsroom (2025 mileage rate); IRS Internal Revenue Bulletin 2024-45 (Section 179 limits for 2025); IRS Internal Revenue Bulletin 2025-11 (bonus depreciation context); IRS Tax Tip and Instructions for Form 2290 (HVUT due dates); IRS Publication 463 and Publication 505 (meals and estimated tax guidance); PwC summary of Notice 2024-85 (1099-K thresholds).

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.