What’s real — and what’s rumor

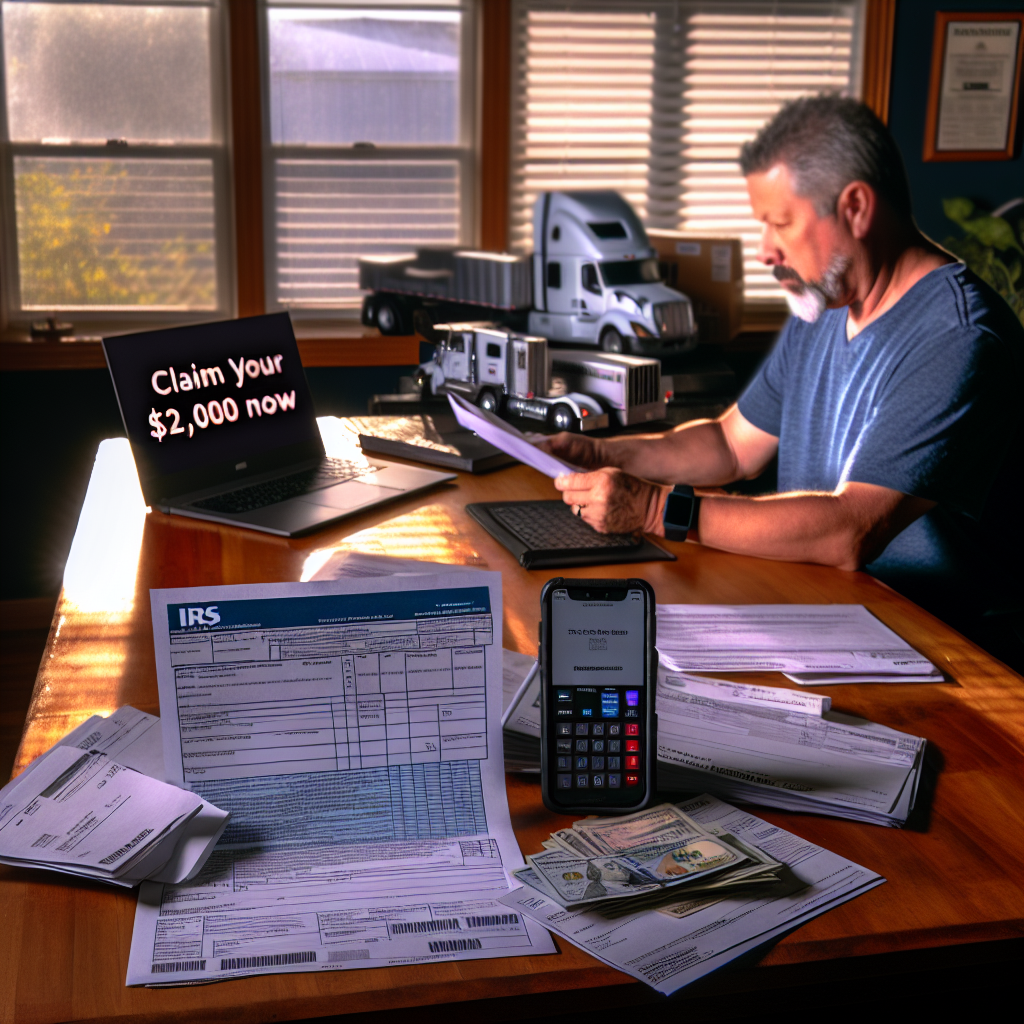

A widely shared post claims the federal government has “confirmed” one-time $2,000 payments in January 2026, outlining supposed eligibility and deposit dates. The article provides no official citations, and our review found no federal announcement backing it up.

As of January 2, 2026, no law has been enacted authorizing new federal stimulus-style checks, and the IRS has said there are no new stimulus payments scheduled without congressional approval. Independent fact-checkers likewise report recent viral claims about new federal checks are false. Proposals floated in 2025 (including ideas for $2,000 “tariff checks”) remain proposals until Congress passes a bill and the President signs it. For trucking businesses, that means you should treat “click to claim” messages as scams, not cash-flow you can plan around.

What payments are actually coming in January 2026

There is a confirmed 2.8% cost-of-living adjustment (COLA) for Social Security and SSI benefits. SSI’s January payment was advanced to December 31, 2025, due to the New Year’s Day holiday; the COLA shows up in regular Social Security checks paid in January on the standard staggered schedule. If you or retired drivers in your fleet rely on these benefits, budget around the known dates, not rumor posts.

Owner-operators and fleets: practical steps to avoid scams

- Don’t click to “claim” a check. The IRS does not initiate stimulus enrollment by text, DM, or email, and it won’t charge a fee to release government payments. Treat unsolicited messages or websites promising fast cash as phishing.

- Expect misdirection using trending terms. Scammers regularly recycle headlines about “stimulus,” “tariff relief,” or “giveback” benefits to harvest SSNs, bank details, and DOT/EIN data.

- Use official .gov channels only. Manage your tax information through IRS online services and ignore third parties offering to “set up” your IRS account for you.

- Brief your back office. Dispatch, payroll, and safety staff should treat any email asking for W‑9s, bank changes, or driver PII as high risk; verify independently using phone numbers you already trust.

January finance checklist for trucking businesses

- Estimated taxes: For 2025 income earned September–December, the estimated tax deadline is January 15, 2026 (unless you file and pay in full shortly after; see IRS rules). Many owner-operators make this Q4 payment to avoid penalties.

- 1099-NEC to contractors: If you paid leased owner-operators or other nonemployees $600+ in 2025, furnish and file Form 1099‑NEC by January 31, 2026. The IRS now expects many filers to submit these electronically.

- Watch for identity fraud red flags: IRS “Dirty Dozen” alerts include schemes built on bad social media advice and fake credits. If you get an unexpected IRS identity‑verification letter, follow the instructions and do not share details over the phone with unsolicited callers.

Bottom line for your cash flow

No federal agency has confirmed a universal $2,000 January 2026 payment. Plan your Q1 cash flow around known obligations (estimated taxes, 1099s) and confirmed government disbursements like Social Security—not viral posts. If a message pushes urgency, asks for upfront fees, or wants bank/SSN details to “release” a federal payment, it’s almost certainly a scam.

Sources Consulted: Social Security Administration; Internal Revenue Service; Associated Press Fact Check; Snopes; The Washington Post; DiscoverDRX.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.