What changed on January 1, 2026

Trucking employers processing 2026 payroll should note several tax updates now in effect. The Social Security (OASDI) taxable wage base rose to $184,500 for 2026, with the OASDI rate unchanged at 6.2% for both employer and employee (12.4% combined). Medicare remains 1.45% each (no wage cap), and the 0.9% Additional Medicare Tax continues to apply on wages above $200,000 paid to an employee within the calendar year. For drivers and back‑office staff who exceed the Social Security ceiling, the maximum OASDI withholding is $11,439 in 2026.

California payroll: SDI rate, no wage cap, and state withholding

If your fleet runs payroll in California, the State Disability Insurance (SDI) withholding rate is 1.3% for 2026. Under SB 951, SDI no longer has a taxable wage ceiling, so all covered wages are subject to SDI contributions—an important budgeting consideration for high‑earning drivers and managers.

For California personal income tax (PIT) on supplemental wages—think hiring bonuses, referral bonuses, safety awards, commissions—the flat withholding rate remains 6.6% (10.23% for stock options and certain bonus payments). Employers may instead aggregate certain supplemental payments with regular wages, but the flat rate is a common choice for separately paid bonuses.

Federal handling of bonuses and other supplemental wages

At the federal level, employers can withhold a flat 22% on most supplemental wage payments (37% once an employee’s year‑to‑date supplemental wages from that employer exceed $1 million). Alternatively, you may aggregate supplemental wages with regular pay and compute withholding as one payment. These rules matter for driver sign‑on bonuses, productivity or safety bonuses, and lump‑sum payouts.

W‑4 “exempt” status expires Feb. 15, 2026

Employees who claimed “exempt from withholding” on a 2025 Form W‑4 must submit a new 2026 Form W‑4 by Tuesday, February 15, 2026, to continue that status. If a new form isn’t received in time, employers must switch the employee to the default “single/standard withholding” until an updated W‑4 arrives. This is a key reminder for seasonal or part‑year drivers and student workers.

Key reminders highlighted for payroll teams

- Update payroll systems with 2026 federal and California rates and brackets so early‑year checks calculate correctly, including the higher Social Security wage base and California’s SDI rate.

- Revisit bonus workflows. For driver sign‑on or safety bonuses paid separately from regular wages, ensure the federal 22% flat rate (or aggregation method) is properly configured; in California, confirm the 6.6% supplemental PIT rate (10.23% for stock options/certain bonuses).

- Watch the Additional Medicare Tax threshold. Once an employee’s wages exceed $200,000 within the year, begin withholding the extra 0.9% for the remainder of the calendar year—there’s no employer match.

- Manage W‑4s proactively. Audit your roster for anyone who claimed federal “exempt” in 2025 and communicate the February 15, 2026 requirement to submit a new W‑4. Until received, default to single/standard withholding.

- In California, collect a DE 4 when employees change their federal W‑4. California requires a state DE 4 any time an employee changes their federal withholding elections.

- Encourage employees to use the IRS Tax Withholding Estimator for a “paycheck checkup,” especially drivers with variable hours, overtime, or multiple jobs that can skew withholding. Remind staff that employers should not provide individualized tax advice.

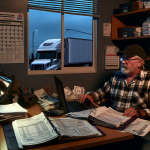

Why this matters to trucking

Driver compensation often includes overtime, incentives, and periodic bonuses—exactly the types of payments affected by supplemental wage rules. The higher 2026 Social Security wage base slightly increases employer payroll tax exposure at the top end, while California’s uncapped SDI means high earners will have SDI withheld all year. Getting these details right avoids costly corrections, protects cash flow, and keeps your drivers’ paychecks accurate.

Bottom line for owner‑operators and fleets

Align your payroll systems now, double‑check bonus withholding settings, audit W‑4 exempt statuses before February 15, and communicate clearly with drivers. When in doubt, reference the latest IRS employer guides and California rules—and steer employees to the IRS estimator or a tax professional for personal guidance.

Sources Consulted: Los Angeles County Office of Education bulletin; Social Security Administration; Internal Revenue Service (Publications 15 and 15‑T); California Employment Development Department; California Revenue & Taxation Code §18663.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.