Why S corps are back in the conversation for trucking

For owner-operators and small fleets weighing entity choices this year, an S corporation (S corp) can pair corporate liability protection with pass‑through taxation. In an S corp, profits, losses, deductions, and credits generally flow to owners’ personal returns, avoiding C‑corp “double tax.” You form (or convert to) a corporation or eligible LLC at the state level, then elect S status with the IRS. Most states follow the federal pass‑through treatment, though some impose separate fees or franchise taxes.

S corp basics owners should know

- It’s a federal tax election, not a separate state entity type. An LLC can elect to be taxed as an S corp if it meets IRS rules.

- Eligibility includes: domestic entity, one class of stock, ≤100 shareholders, and only eligible owners (generally individuals who are U.S. citizens or residents, certain trusts/estates).

- You must file IRS Form 2553 to elect S status. Timing is generally within 2 months and 15 days after the start of the tax year you want the election to take effect (for calendar-year filers, that’s typically by March 15). Late‑election relief may be available under Rev. Proc. 2013‑30.

Why S corps appeal to truckers

- Self‑employment tax management: As an owner, you’re both a shareholder and an employee. Paying yourself a “reasonable” W‑2 wage for the work you perform, then taking any remaining profit as distributions, can reduce employment taxes compared with reporting all profits as self‑employment income. The IRS closely polices this—document your compensation analysis.

- QBI deduction remains in play: For many pass‑throughs, the up‑to‑20% qualified business income (QBI) deduction was made permanent beginning in 2026 under the One Big Beautiful Bill Act, with higher phase‑in ranges. That can further lower taxable income for profitable S‑corp owner‑operators and small fleets.

- Losses can pass through in lean years: Startup or down‑cycle losses can offset other personal income (subject to basis/at‑risk/passive limits).

- Corporate credibility and continuity: Incorporating can help with vendor relationships, financing, and succession. Ownership interests are easier to transfer than in many sole props/partnerships.

- Accounting flexibility: Many S corps can use the cash method unless inventory rules apply—useful for cash‑flow management.

Tradeoffs and traps to watch

- Payroll and admin overhead: You’ll run payroll (with withholdings and employer taxes), keep corporate minutes, and pay state annual report or franchise fees—costs sole proprietors don’t incur. Multi‑state operations can add payroll nexus and filing complexity.

- Ownership limits: Only one class of stock, a hard cap of 100 shareholders, and no nonresident alien or corporate owners. If you later seek outside investors or complex equity, these rules can pinch.

- Calendar‑year rule: S corps generally must use a calendar year unless a business purpose for a fiscal year is approved.

- IRS scrutiny of “reasonable comp”: If wages are too low relative to the services you provide, the IRS can reclassify distributions as wages and assess back payroll taxes and penalties. Keep pay surveys, duty lists, and time records.

- Fringe‑benefit limits for 2% owners: Health insurance for ≥2% shareholder‑employees is generally included in wages (then potentially deducted on the owner’s return), and some cafeteria‑plan exclusions don’t apply. Plan reimbursements accordingly.

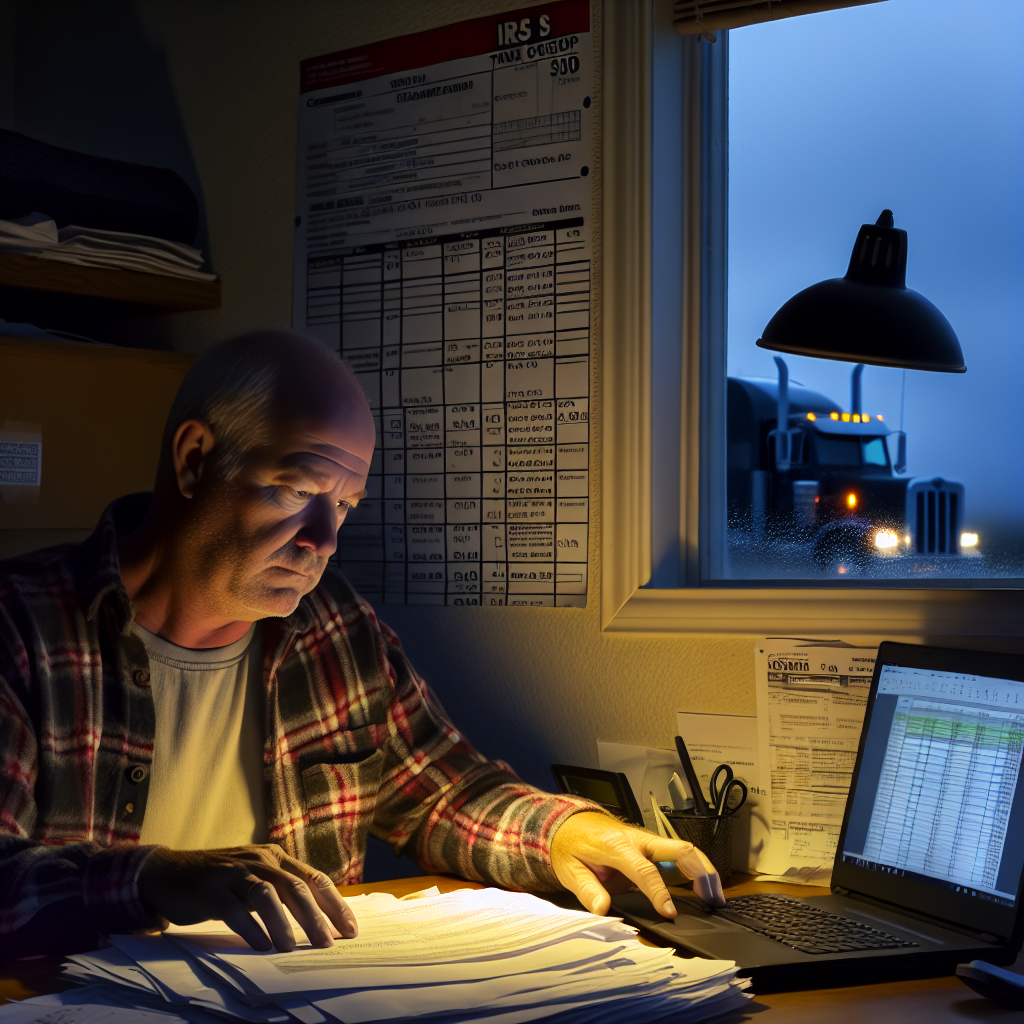

How this plays out in trucking

For a one‑truck owner‑operator who nets well above a market‑rate driver/dispatcher salary after fuel, maintenance, insurance, and permits, an S corp can create payroll‑tax savings while preserving liability protection. Document the “reasonable” wage using comparable pay for the driving and management you actually perform, then consider taking the balance as distributions. For small fleets, S‑corp status can still make sense, but payroll across multiple states, per‑diem reimbursements under an accountable plan, and owner‑benefit rules demand tighter bookkeeping and HR/payroll processes. The IRS specifically notes that when significant gross receipts come from non‑owner employees and capital/equipment (tractors, trailers), more profit may properly flow as distributions—again, with solid documentation.

Action steps and 2026 timing

- Run the math: Model net profit after a market‑rate wage to see if S‑corp savings offset added payroll/admin costs.

- Form the entity and elect S status: File your Articles of Incorporation or convert your LLC if needed, then file IRS Form 2553 on time (generally by March 15 for calendar‑year filers). If you missed it, discuss late‑election relief under Rev. Proc. 2013‑30 with your tax pro.

- Dial in compliance: Set a defensible owner‑wage, adopt an accountable plan for reimbursements, and keep minutes and payroll records that match reality.

- Ask about QBI: Confirm your eligibility and whether the permanent, 20% QBI deduction meaningfully reduces your 2026 liability.

Bottom line for fleets and O/Os: An S corp can be a smart chassis for liability protection and tax efficiency in 2026—but only if you respect the rules, price in the admin, and document owner pay like you expect an audit.

Sources Consulted: Wolters Kluwer; Internal Revenue Service; U.S. Small Business Administration; Loeb & Loeb LLP.

Need to file your Form 2290?

Join thousands of owner-operators and carriers who trust HeavyTax.com for fast and easy HVUT e-filing.

This article was prepared exclusively for truckstopinsider.com. For professional tax advice, consult a qualified professional.